Richmond/Delta Multifamily Submarket Report – Q1 2025

Richmond/Delta Multifamily Market Snapshot

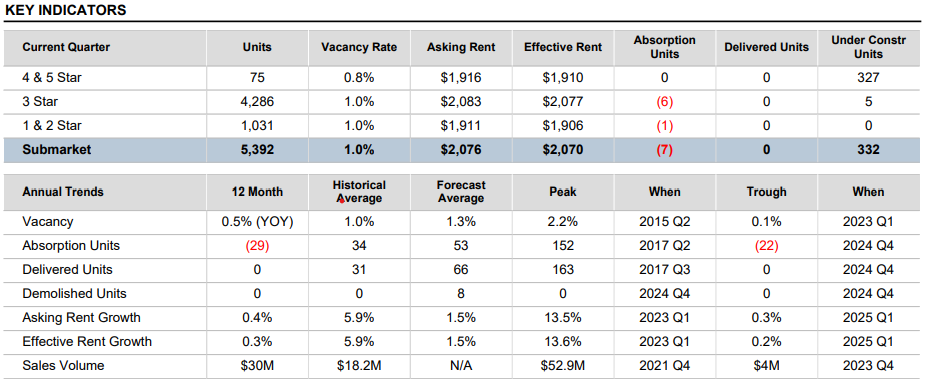

Vacancy: 1.0% (up 0.5% from last year) Absorption: -28 units in past year Average Rent: $2,080/month (up 0.4% year-over-year) New Construction: 330 units underway Recent Sales: One transaction at $30 million

Building Class Performance:

- 3 Star: 1.0% vacant, $2,080/month rent (+0.3% annually)

- 1 & 2 Star: 1.0% vacant, $1,910/month rent (+3.8% annually)

- 4 & 5 Star: $1,920/month rent (+1.8% annually)

Three-Year Trends:

- Vacancy higher than 0.5% three-year average (below Vancouver’s 1.4%)

- Inventory grew by 57 units (all from construction)

- Rents increased 22.3% (outpacing Vancouver’s 15.0%)

- Total market size: 5,400 units

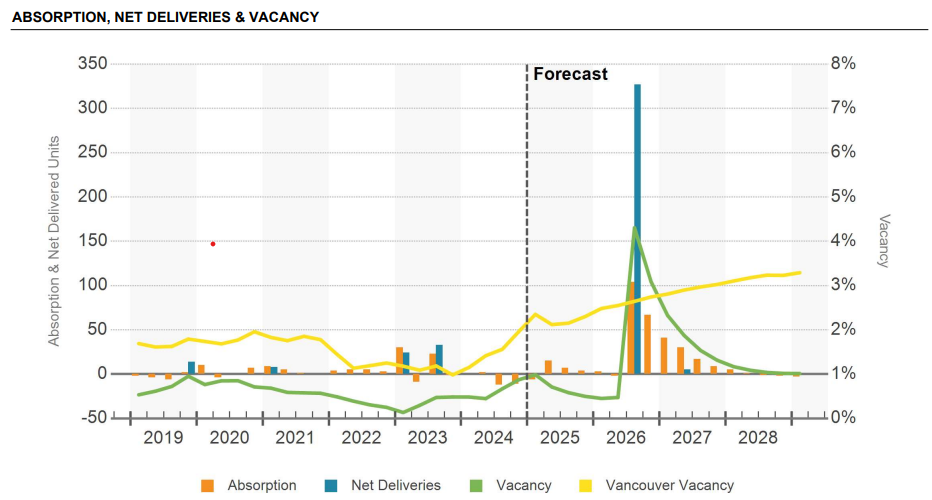

Richmond/Delta Multi-Family- Vacancy

Vacancy Rate

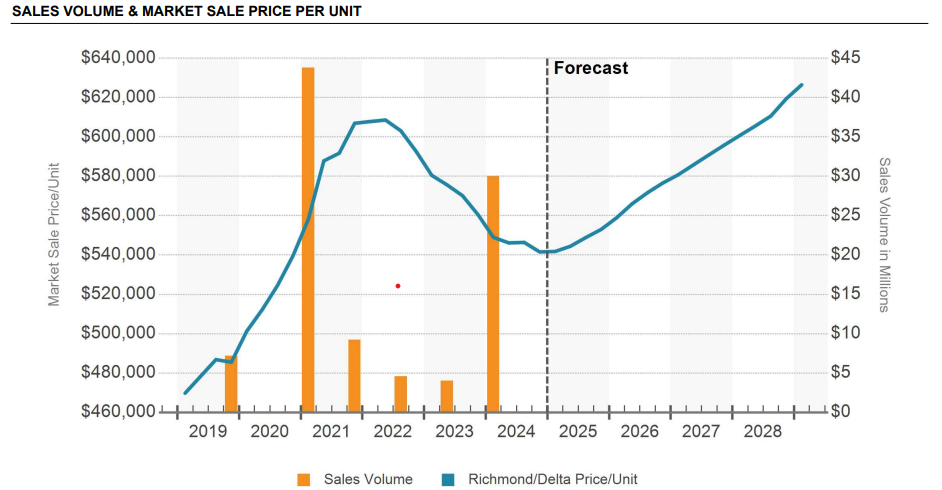

Sales

Richmond/Delta Multifamily Investment Activity

The Richmond/Delta submarket recorded just one multifamily transaction in the past year, trading at $441,176 per unit. This sale price came in below the submarket’s estimated value of $542,415 per unit. The property involved was classified as a 3 Star building.

Looking at a broader timeframe, the Richmond/Delta area has averaged 2 sales annually over the past three years, with typical annual volume of $7.8 million representing about 47 units per year.

The overall market cap rate for Richmond/Delta stands at 3.2%, slightly higher than the wider market average of 3.1%.