Abbotsford/Chilliwack Industrial Market Report – Q1 2025

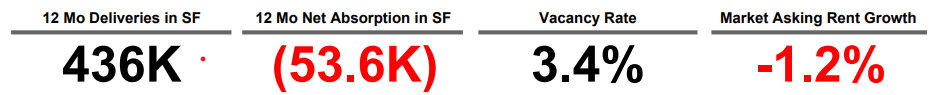

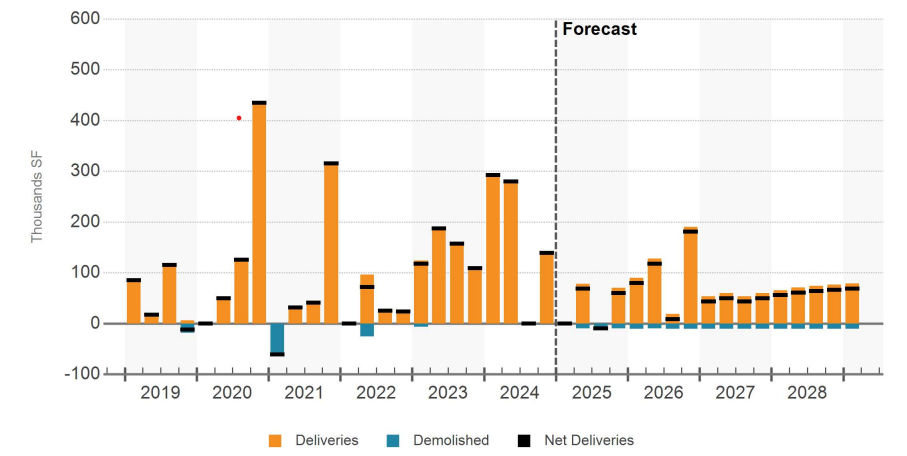

The Abbotsford/Chilliwack industrial market has seen one of the most dramatic shifts in vacancy rates this year among Vancouver’s submarkets. Vacancy now sits at 3.4%, jumping up 2.6% since January – significantly higher than the metro average increase of 1.5%. Of the 440,000 square feet delivered in the past year, a concerning 60% remains vacant. Xchange Business Park exemplifies this challenge, with two buildings totaling 260,000 SF still available at $19/SF net.

While quarterly leasing activity typically fluctuates here, strong performance in Q2 and Q4 helped reach over 350,000 SF leased in 2024 – the area’s second-best year, trailing only 2022. Pre-leased construction projects have helped cushion what would otherwise be worse absorption figures. Even so, the area recorded negative absorption of 54,000 SF over the past year. Some bright spots include Cintas taking 36,000 SF at Xchange Business Park’s Building 3, and Play Abby securing 56,000 SF at Commercial Court’s Building 4 in Chilliwack. Looking ahead, Jake’s Construction will take possession of their purpose-built 50,000 SF facility on Progress Way later this year, while Red Bull is slated to occupy their new 185,000 SF Chilliwack warehouse in late 2026. Worth noting, both expansions represent net new absorption as neither company will be giving up their current locations.

Currently, 550,000 SF is under construction across the submarket. Setting aside the Red Bull and Jake’s build-to-suits, roughly 60% of the remaining development space lacks committed tenants. Riverside Road Business Park represents the largest development, offering 215,000 SF across three buildings with various bay sizes. As a condo development, it’s priced between $450-500/SF. Other projects are lease-only, asking $15.00-16.50/SF net.

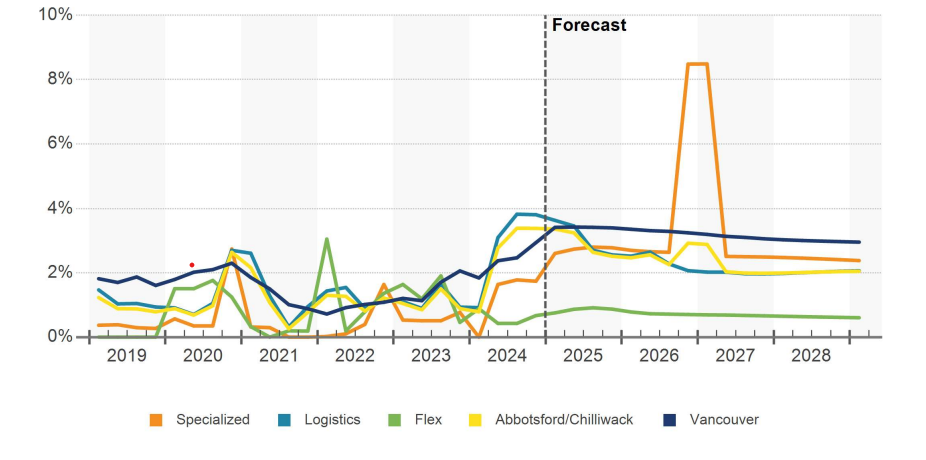

Rental rates have started sliding, down 1.2% year-over-year. We expect further softening through 2025, potentially dropping 3% by mid-year, with growth unlikely before 2026. Current average rents sit at $18.70/SF, below the regional average of $20.00/SF. Throughout the region, 2025 leasing activity has slowed amid uncertainty about potential tariff impacts. Industry sources indicate tenants are increasingly adopting a cautious “wait and see” approach to space decisions. The market will likely remain sluggish until economic uncertainty subsides, with property owners increasingly competing to attract the dwindling number of businesses still actively seeking industrial space.

Key Indicators

Net Absorption, Net Deliveries & Vacancy- Leasing

Vacancy Rate- Leasing

Market Asking Rent Growth (YOY)- Rent

Deliveries & Demolitions- Construction

Sales

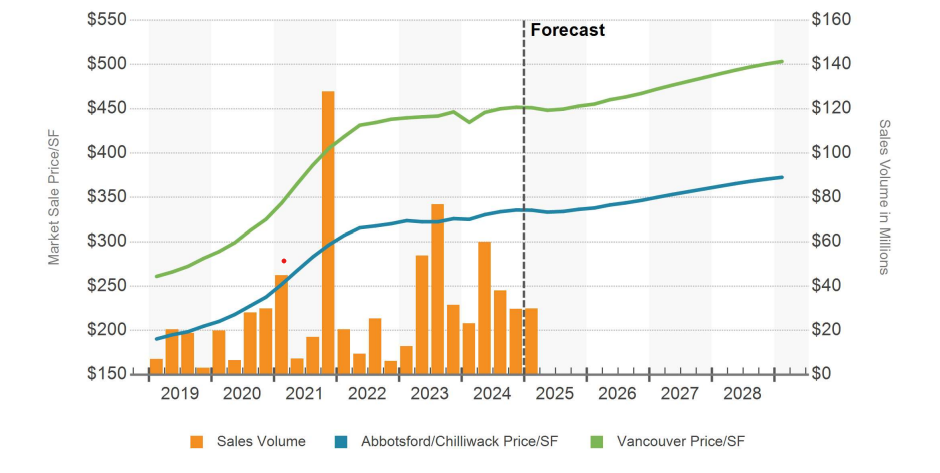

Despite broader market headwinds, investment has remained surprisingly strong in the Abbotsford/Chilliwack corridor. Q2 2024 saw a surge in deals as investors rushed to beat anticipated capital gains tax changes, which have since been postponed to 2026. The submarket achieved quarterly investment volumes exceeding $30 million from Q2 through Q4—only the second time in ten years that this milestone has been reached for three consecutive quarters. Annual investment totaled $166 million across 56 transactions, outperforming the five-year average of $118 million.

The past year has seen a notable shift in buyer demographics, with owner-occupiers dominating the Abbotsford/Chilliwack market. While end users typically drive smaller transactions under $5 million, they’ve surprisingly claimed nine of the top ten deals since mid-2024. A significant contributor to investment volume has been the industrial condo project at 31453 King Road, completed in early 2024, which generated approximately $25 million through four separate sales at prices ranging from $450 to $475 per square foot.

Sales Volume & Market Sales Price Per SF

Sales Past 12 Months

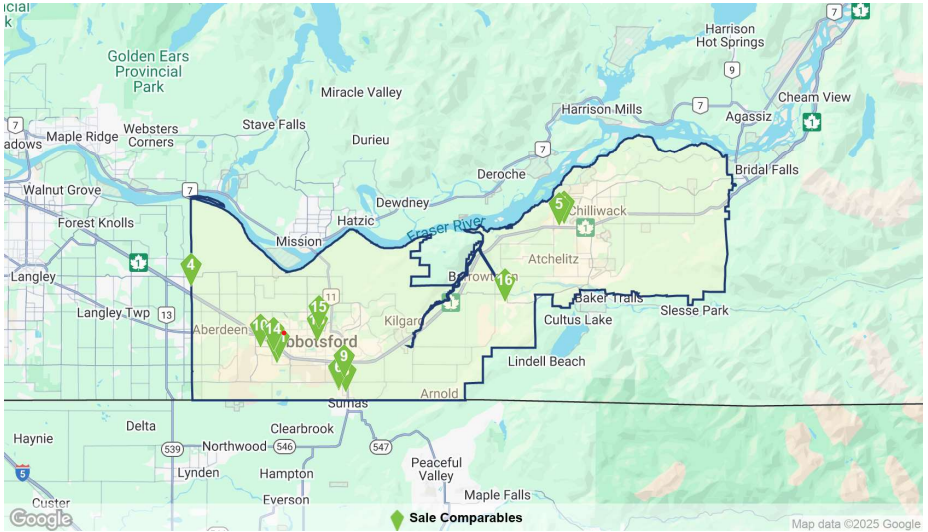

Sale Comparable Locations

You May Also Read- Surrey/Langley Industrial Market Report – Q1 2025